Toronto, Ontario--(NEWSFILE CORP. November 29, 2023) - Tenet Fintech Group Inc. - (CSE: PKK) (OTC Pink: PKKFF) ("Tenet" or the "Company"), an innovative analytics service provider and owner and operator of the Cubeler® Business Hub, today announced its financial results and operating highlights for the three-month and nine-month periods ended September 30, 2023, and September 30, 2022.

The impact of the disruption in the Company's operations in both China and Canada during the second quarter of 2023 continued to take its toll on the Company's revenue during the third quarter. Tenet reported total revenue of $9.2M for the quarter and a net loss of $43.0M. The net loss reported includes $36.4M of non-cash impairment charges attributed to delays in forecasted revenue from the Company's Heartbeat platform in China and its Cubeler platform in Canada. The Company is hopeful that a significant portion of these impairment charges (excluding goodwill) may be reversed in future quarters as the platforms become significant revenue generators for the Company. All amounts expressed in this news release are in Canadian dollars.

Q3 Financial Highlights:

• Total Revenue of $9.2M

• Net Loss of $43.0M

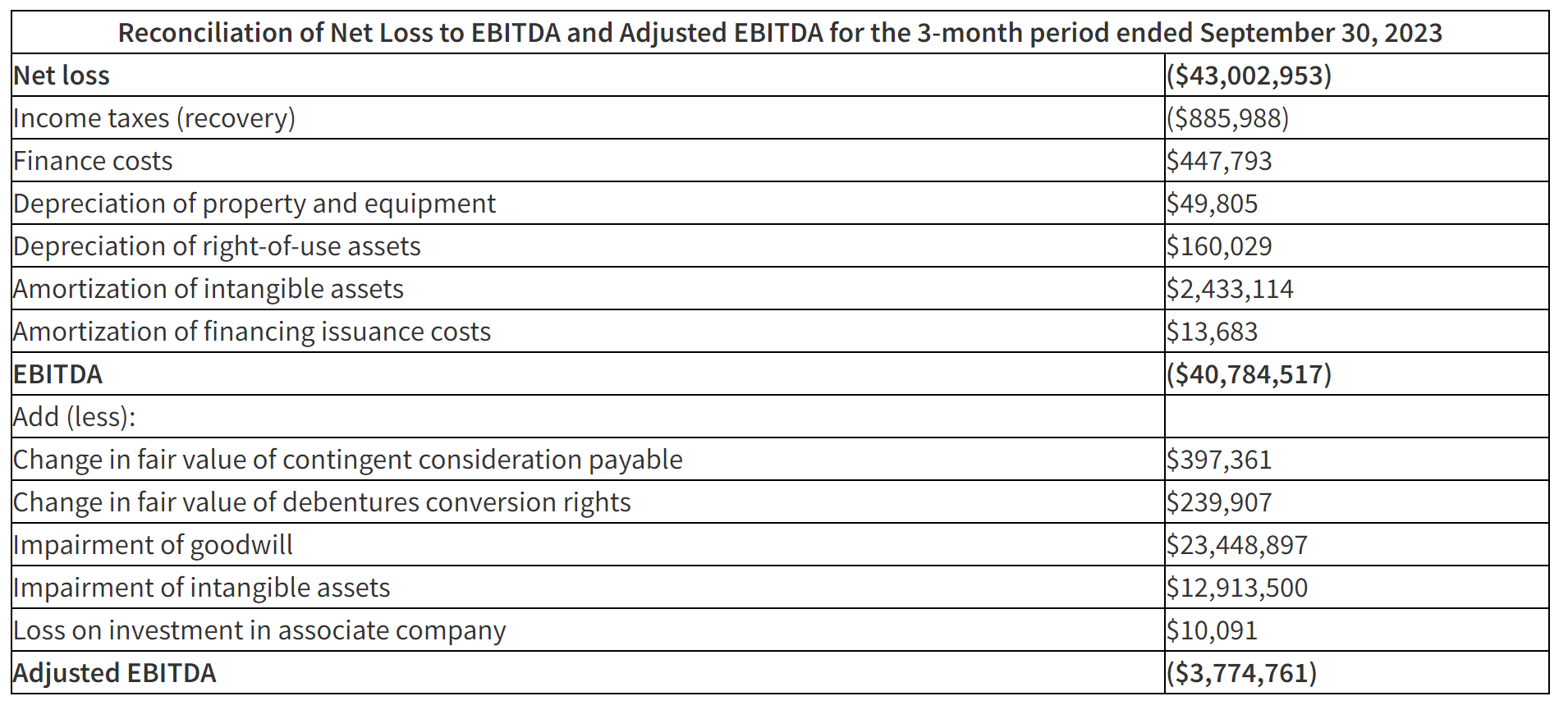

• EBITDA* of ($40.8M)

• Adjusted EBITDA** ($3.8M)

* EBITDA is a non-IFRS financial measure provided to assist readers in determining the Company's ability to generate cash-flows from operations and to cover finance charges. It is also widely used for business valuation purposes. This measure does not have a standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.

EBITDA equals the results before income taxes, depreciation of property and equipment, depreciation of right-of-use assets, amortization of intangible assets, amortization of financing issuance costs and finance costs, as defined in Note 18.4 of the Unaudited Condensed Interim Consolidated Financial Statements for the three-month and nine-month periods ended September 30th, 2023.

** Adjusted EBITDA equals EBITDA as described above adjusted for change in fair value of contingent consideration payable, change in fair value of debenture conversion rights, impairment of goodwill, impairment of intangible assets, gain on bargain purchase and loss on investment in associate company.

Q3 Operating Highlights:

• Closing of $10.9M of planned total of $20M private placement financing

• Strategic alliance with Certified Professional Bookkeepers of Canada

SUMMARY OF THIRD QUARTER OPERATING RESULTS

As a development-stage company, timely access to capital continues to be an important element for the execution of Tenet's business plan. One of the main priorities for the Company in the third quarter, following the events that had occurred in Q2, was to ensure that it would have the capital to carry out its business plan for the coming year. The Company estimated that it would need approximately $20M to do so and was able to raise about $10.9M of that amount during the quarter. Tenet expects to close on the balance of the target amount by the end of 2023. However, there can be no assurances that the Company will be successful in doing so.

In addition to shoring up its finances, Tenet spent a significant portion of the quarter on activities related to preparing the Company's transition from a predominantly transaction fee based revenue model to a predominantly data-driven subscription fee based revenue model. This implied resuming the development of the Cubeler® Business Hub's Networking, Advertising and Insights pillars, putting more emphasis on industrial and geographic diversification and expansion of Tenet's service offering in China, and on partnerships with business associations, bookkeepers, accounting software vendors, and others with large numbers of small and medium-sized business clients or members, that the Company can work with to promote the benefits of membership on the Cubeler® Business Hub. The Company believes the strategic alliance it was able to forge with Certified Professional Bookkeepers of Canada during the quarter will significantly impact its ability to rapidly add members to the Cubeler® Business Hub once the Networking and Advertising pillars of the Hub are live sometime during the first quarter of 2024.

OPERATIONAL OUTLOOK FOR Q4 2023 AND FISCAL 2024

While Tenet's revenue in Q3 was still entirely generated under a predominantly transaction fee based model in China, transitioning to a predominantly subscription fee based revenue model, offering data-driven analytics and AI-based products and services to global capital markets participants, will be the Company's main focus in Q4 2023 and beyond. Tenet estimates the market for its ie-Pulse product offering in North America to be between $45 million and $450 million1 in monthly subscription fees, and the addressable market for its Equity Insider product offering in North America to be between $575 million and $2.3 billion2 in monthly subscription fees. The Company believes that a prompt transition to this phase of its strategic plan will be most beneficial to its shareholders in both the short run and the long run and therefore endeavors to take the necessary steps to start to commercialize its initial data-driven products in North America sometime during the first half of 2024. More information about Tenet's upcoming data-driven product offering is available at www.tenoris3.com.

1. Calculated based on the estimated number of banks, credit unions, full-service brokerage firms, hedge funds, and mutual fund companies in Canada and the U.S. (approximately 45,000, according to Statista, IBISWorld, Mordor Intelligence and Wikipedia) multiplied by a monthly subscription fee of $1,000 to $10,000.

2. Calculated based on the estimated number of individuals in Canada and the U.S. with discount brokerage accounts (approximately 115 million, according to Statista) multiplied by a monthly subscription fee of $5 to $20.

Tenet by no means plans to forego the transaction fee based revenue it generates in China. Rather, this form of revenue is expected to go from playing a leading role to a supporting role in how the Company generates revenue in the future, complementing the data-driven revenue the Company expects to generate in North America and eventually in other parts of the world, including China.

SUMMARY OF THIRD QUARTER FINANCIAL RESULTS

In summary, the Company generated revenue of $9,244,460 for the three-month period and $35,514,978 for the nine-month period ended September 30, 2023, compared to $21,585,258 for the three-month period and $88,758,946 for the nine-month period ended September 30, 2022.

Total expenses before taxes for the quarter amounted to $53,133,401 compared to $30,164,621 for the same period in 2022. Net loss for the third quarter of 2023 was $43,002,953 compared to a net loss of $7,715,209 for the same period in 2022.

Full details of the Company's third quarter 2023 financial results can be found in the Unaudited Condensed Interim Consolidated Financial Statements and Management's Discussion and Analysis (MD&A) for the three-month and nine-month periods ended September 30, 2023 and September 30, 2022, which are available at www.sedarplus.com.

Tenet will host a conference call on Thursday, November 30 at 9:00 am EST, where President & CEO Johnson Joseph, CFO Jean Landreville and COO Mayco Quiroz will discuss the Q3 2023 financial results and the Company's operational outlook for Q4 2023 and fiscal year 2024. Registration for the event is available at: www.app.webinar.net.

About Tenet Fintech Group Inc.:

Tenet Fintech Group Inc. is the parent company of a group of innovative financial technology (Fintech) and artificial intelligence (AI) companies. All references to Tenet in this news release, unless explicitly specified, include Tenet and all its subsidiaries. Tenet's subsidiaries provide analytics and AI-based services to businesses and financial institutions through the Cubeler® Business Hub, a global ecosystem where analytics and AI are used to create opportunities and facilitate B2B transactions among its members. Please visit our website at: www.tenetfintech.com.

For more information, please contact:

Tenet Fintech Group Inc.

Mayco Quiroz, Chief Operating Officer

514-340-7775 ext.: 510

investors@tenetfintech.com

CHF Capital Markets

Cathy Hume, CEO

416-868-1079 ext.: 251

cathy@chfir.com

Follow Tenet Fintech Group Inc. on social media:

Twitter: @Tenet_Fintech

Facebook: @Tenet

LinkedIn: Tenet

YouTube: Tenet Fintech

Forward-looking information

Certain statements included in this press release constitute "forward-looking statements" under Canadian securities law, including statements in respect to the future operations and investments of and in the Company and any statements based on management's assessment and assumptions and publicly available information with respect to the Company. By their nature, forward-looking statements involve risks, uncertainties and assumptions. The Company cautions that its plans and assumptions may not materialize and that current economic conditions render such assumptions, although reasonable at the time they were made, subject to greater uncertainty. Forward-looking statements may be identified by the use of terminology such as "believes," "expects," "anticipates," "assumes," "outlook," "plans," "targets", or other similar words. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different from the outlook or any future results, performance or achievements implied by such statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements. Important risk factors that could affect the forward- looking statements in this news release include, but are not limited to, holding company with significant operations in China; general economic and business conditions, including factors impacting the Company's business in China such as pandemics (ex.: COVID-19); legislative and/or regulatory developments; global financial conditions, repatriation of profits or transfer of funds from China to Canada, operations in foreign jurisdictions and possible exposure to corruption, bribery or civil unrest; actions by regulators; uncertainties of investigations, proceedings or other types of claims and litigation; timing and completion of capital programs; liquidity and capital resources, negative operating cash flow and additional funding, dilution from further financing; financial performance and timing of capital; and other risks detailed from time to time in reports filed by the Company with securities regulators in Canada, the United States or other jurisdictions. We refer potential investors to the "Risks and Uncertainties" section of the Company's MD&A. The reader is cautioned to consider these and other risks and uncertainties carefully and not to put undue reliance on forward-looking information.

Forward-looking statements reflect information as of the date on which they are made. The Company assumes no obligation to update or revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs, unless required by applicable securities laws. In the event the Company does update any forward-looking statement, no inference should be made that the Company will make additional updates with respect to that statement, related matters, or any other forward-looking statement.